How to Invest in AI: A Builder's Guide to the AI Value Chain

How to invest in AI can be a challenge. We show the different layers of the AI value chain to help you identify AI investment options.

The pace of AI innovation is breathtaking. Every day, headlines announce new models, new capabilities, and new companies that promise to change the world. For business leaders and investors, the noise can be deafening, and the pressure to participate is immense. The decision to invest in AI is no longer a question of if, but how and where. As a firm that builds and implements custom AI solutions daily, we at Dentro have a unique perspective – one from the trenches, not the cheap seats. We see what works, what’s overhyped, and which parts of the ecosystem have real, enduring power.

To be super clear: this post is not financial advice. It is a subjective analysis from our point of view as builders. We want to pull back the curtain a bit and show you the different technological layers of the AI revolution. By understanding the complete stack, from the silicon chips to the user-facing applications, you can make more informed decisions about how to invest in AI and where true, long-term value is being created.

The Core Components of AI: The Full Stack

To truly grasp the AI landscape, you have to see it as a complete, multi-layered ecosystem – a really big technology stack. **Each layer depends on the one below it, and value flows through the entire system. **When you invest in AI, you're placing a bet on one or more of these layers (or a little piece within it, depends). Understanding this AI value chain is the first step toward navigating the market intelligently.

The Foundational Layer: Hardware

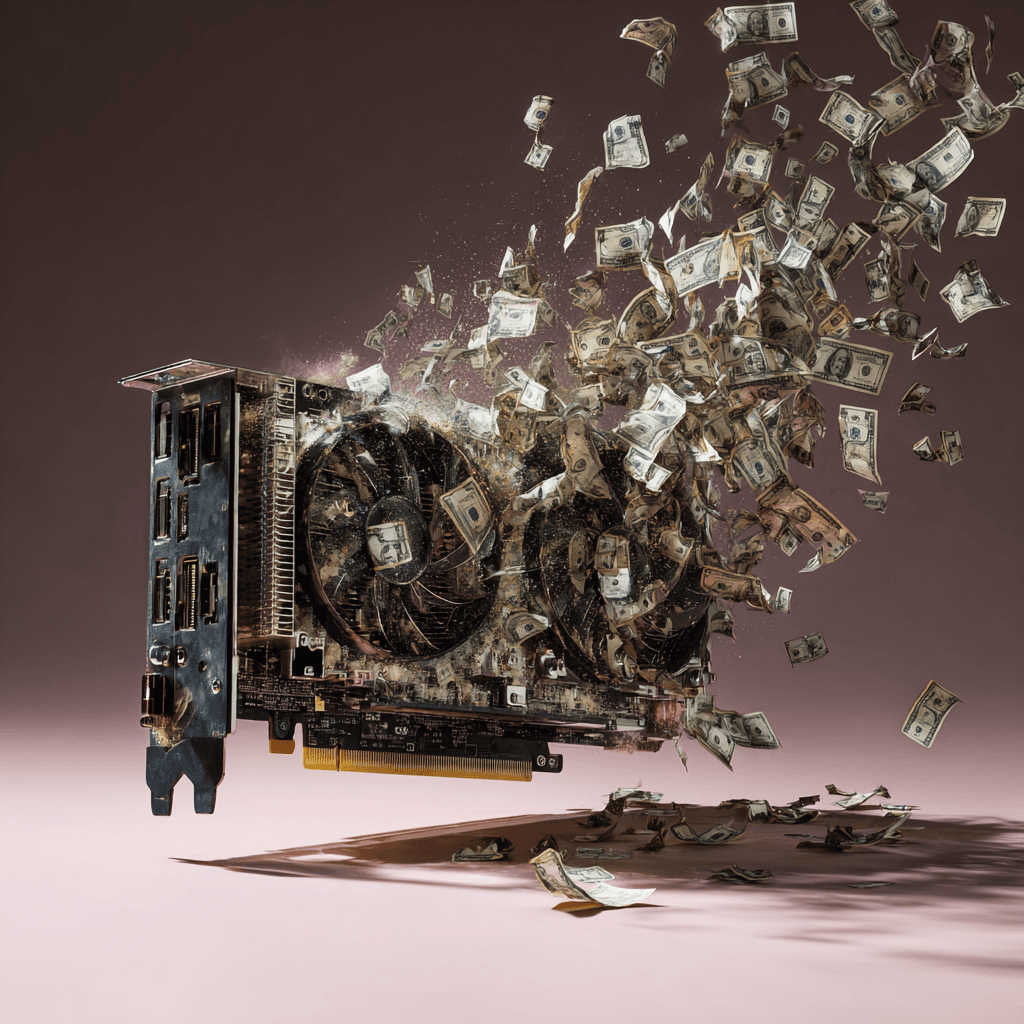

At the very bottom of the stack is the physical backbone: the hardware. This layer is the bedrock upon which everything else is built. Modern AI, especially large language models (LLMs), requires an astonishing amount of computational power to both train and operate (a process known as "inference"). This has created an immense appetite for specialized chips, primarily Graphics Processing Units (GPUs).

Think of these hardware companies as sort of the modern-day "pick and shovel" makers in a gold rush. While others hunt for gold (the next killer app), these companies are selling the essential tools to everyone. Players like Nvidia, with its dominant market position, and competitors like AMD and custom silicon from cloud providers (e.g., Google's TPUs, Amazon's Trainium), are the fundamental enablers of the entire AI revolution.

Their technology is not just a component. It's the critical resource that dictates the pace of innovation for every other layer of the stack. An investment in AI at this level is a bet on the continued, explosive growth of computational demand, regardless of which specific model or application wins out in the end. The sheer necessity of this layer makes it a compelling area for anyone looking to invest in AI with a long-term perspective.

The Intelligence Layer: Foundation Models

Sitting on top of the hardware are the "brains" of the operation: the foundation models. These are the massive LLMs and other generative models, like image generators, that have captured the public's imagination. Trained on vast datasets, these models are what produce human-like text, create stunning visuals, and analyze complex information.

This layer is a bit of a battlefield of giants. Companies like OpenAI (partnered with Microsoft), Google (with its Gemini models), and Anthropic (backed by Amazon and Google) are investing billions of dollars to create the most powerful and general-purpose models. However, one of the most important dynamics to understand here is the tension between these closed-source, proprietary models and the rapidly advancing world of open-source alternatives.

Models like Meta's Llama series, France's Mistral AI or China's Deepseek are freely available for companies to use and modify. This open-source movement is a powerful democratizing force. It prevents a complete market lock-in by a few tech giants and allows companies like ours to build highly customized, private, on-premise solutions for clients. This dynamic is a crucial factor when considering how to invest in AI, as the value in this layer is split between a few big players and a vibrant, collaborative ecosystem. And the later is catching up quickly.

The Application Layer: Where AI Meets Reality

This is the top layer of the stack, and it's our home turf at Dentro if you will. The application layer is where the raw power of foundation models is used to solve specific, real-world business problems. It’s where a general tool becomes a targeted solution. If a foundation model is a brilliant but unfocused mind, an application is that mind given a specific job, the right tools, and a clear goal.

This is where you find AI-powered chatbots for customer service, systems that automate the summarization of legal documents, tools for analyzing financial reports, and intelligent software that helps doctors diagnose diseases. While this layer is where customers see the magic, it's also the most crowded and competitive part of the stack, a critical point we will return to when we go deeper into how to invest in AI.

The Frontier: Robotics & Embodied AI

Looking ahead, we see the convergence of AI software with physical hardware in the form of robotics and embodied AI. This is where AI moves out of the data center and into the physical world. Think of industrial robots performing complex assembly tasks, autonomous vehicles navigating city streets, and humanoid robots working alongside people in warehouses and hospitals. Especially humanoid robots could be a very interesting area, as applications are pretty much unlimited, in both business context as well as a consumer product. An investment in AI here is a bet on the long-term future of automation.

How Capital Flows Through the AI Ecosystem

Understanding the stack is one half of the equation. The other half is understanding the mechanisms through which capital is deployed into these layers. There are several AI investment options, each with a different risk profile and level of accessibility.

The Public Markets: Stocks and ETFs

For most people, the most direct way to invest in AI is through the public stock market. This route itself offers different approaches.

- Individual Stocks: Buying shares of an individual company is a direct bet on that company's strategy and its ability to execute within its chosen layer of the stack. Buying shares in a hardware company is a bet on the foundational infrastructure. Investing in a major tech company that has integrated AI into its products is a bet on the application and model layers. This is a high-reward, high-risk option, as your success is tied to the fortunes of a single company. Or multiple companies of course, if you choose to diversify a bit.

- AI-Focused ETFs: For those seeking a bit more diversification and wanting to avoid stock picking, Exchange-Traded Funds (ETFs) offer a way to bet on the growth of an entire theme or layer. There are ETFs that focus on robotics, cybersecurity, cloud computing, or the semiconductor industry. This approach allows you to invest in a basket of companies, spreading the risk instead of trying to pick the one winner. It’s one of the most popular AI investment options for those who believe in the overall trend but not in any single company in particular.

The Private Markets: The Early Stage Opportunity

Beyond the public markets lies the world of venture capital and private equity. This is where capital is placed to try and build the next major company. Startups working on novel foundation models or disruptive AI applications are often funded this way long before they ever go public. This is a high-risk, high-reward arena that offers the potential for outsized returns, but it comes with a major caveat: a very high barrier to entry. This path to invest in AI typically requires significant capital, a strong professional network to gain access to the best deals, and the ability to tolerate long periods of illiquidity.

As it's difficult for private individuals to invest in non-public companies, a way around this could be to invest in companies that hold shares in those private companies. An example would be Microsoft as an early investor in OpenAI. So if you hold Microsoft stock you'd passively also benefit from their investment in OpenAI as a non-public company.

Our Perspective: The Value Shift

Now, with a clear understanding of the stack and the flow of capital, we can share our core perspective from the builder’s chair. This is where we analyze the AI hype vs reality and pinpoint where we believe durable value lies.

Beyond the Application Hype

At Dentro, we live and breathe the application layer. It’s where we create direct value for our clients. However, from an investment standpoint, we believe it is the riskiest layer of the stack. The barrier to entry for creating a simple "wrapper" around a major API like OpenAI's is comparatively low. This has led to a market that is flooded with thousands of near-identical applications of which only a hand full will survive.

Many of these companies have a very thin competitive moat; they could be easily replicated or made obsolete overnight by a new feature from the foundation model provider itself. This is the stark truth of the AI hype vs reality: while the applications are flashy, their underlying business models can be fragile. To invest in AI at this layer requires a deep conviction that a company has a unique distribution channel, proprietary data, or a deep-seated workflow integration that protects it from the competition.

Our Bet: The Enduring Value of Hardware

From our vantage point, the most durable, long-term growth potential lies in the foundational layers, specifically hardware. The logic is simple: every single part of the AI stack, from research and model training to running applications for billions of users, consumes computational power. This demand is not just growing; it's accelerating.

We see a critical "second wave" of demand on the horizon. The initial AI boom was fueled by Big Tech and well-funded startups. But the next massive wave will come from the world's Small and Medium-sized Businesses (SMBs). As they begin to adopt custom AI for data privacy, deeper integration, and cost control, they will need their own dedicated computing resources, whether on-premise or in private clouds. This will create a vast, new, and sustained market for GPU providers, solidifying to a certain degree the importance of companies that produce these foundational tools. This makes looking into AI hardware stocks such as Nvidia, AMD, or AMSL a compelling exercise for any serious long-term investor.

The Hardware Battleground

The competition in the hardware space is fierce and sophisticated. Nvidia's current dominance is not just due to its powerful chips; it's reinforced by its CUDA software platform. This extensive software library creates a powerful "moat" through developer lock-in. Millions of developers are trained on it, and entire software ecosystems are built around it, making a switch to a competitor overt time more difficult and costly.

However, this dominance is being challenged. Competitors like AMD are aggressively competing on price-to-performance ratios and energy efficiency. Furthermore, the major cloud players are developing their own custom silicon to optimize performance for their specific workloads and reduce their reliance on a single supplier. This battle for the foundational layer of the AI value chain will be one of the most important stories to watch in the coming years – and actually already is.

Conclusion: The Ultimate Investment

The AI landscape is a complex, multi-layered ecosystem offering a variety of ways to participate, each with its own risk-reward profile. From the silicon in the hardware layer to the intelligent models and the real-world applications, understanding the full stack is crucial for seeing beyond the hype and making informed decisions. Deciding how to invest in AI is one of the most significant strategic questions of our time.

While you can invest in the companies building the AI infrastructure, the most powerful way to capitalize on the revolution is to invest in your own business's capabilities. Building a custom AI solution is a direct investment in your own efficiency, competitive advantage, and future. If you're ready to move from observer to participant, let's talk. We help businesses navigate the stack and build the application that delivers tangible value for you.